Introduction

Banks waiting on AI are estimated to leave millions on the table.

AI in banking is no longer experimental. It’s delivering these estimated ROI Opportunities:

📈 30-40% decrease in call center volume with conversational AI

📈 50-70% faster resolution time using AI-assisted service agents

📈 70%+ operational gain using AI to summarize interactions and suggest next steps

📈 35% increase in cross-sell conversions

📈 Up to 40% operational cost reduction in key processes

📈 70% faster loan processing

📈 60% improvement in fraud detection accuracy

It’s predicted that the banking industry could unlock up to $1 trillion annually with AI (Source: McKinsey).

Generative AI in Banking is revolutionizing it by significantly boosting employee productivity, operational efficiency, and customer experiences. This transformation is driven by advanced AI models, with a strong emphasis on responsible development and human oversight. (Source: Microsoft)

The only question: Will your bank capture this value, or will your competitors?

This also leads us to question, what are the use cases of AI in banking?

Here we list 5 proven, practical AI use cases you can deploy immediately using Microsoft’s secure AI ecosystem to improve operational efficiency, customer satisfaction, and compliance.

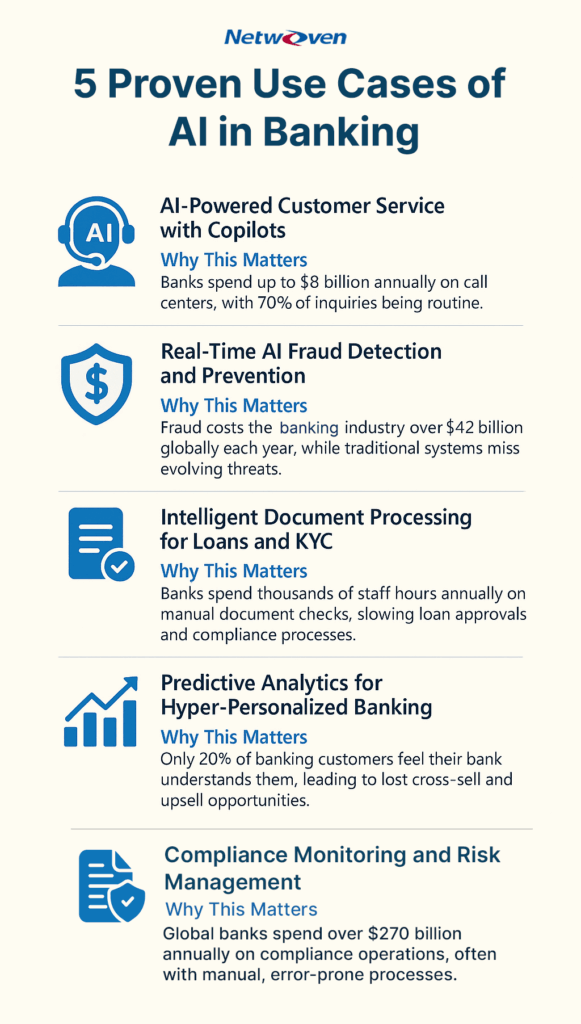

1. AI-Powered Customer Service with Copilots

Why This Matters

Banks spend up to $8 billion annually on call centers, with 70% of inquiries being routine.

What You Can Deploy

AI copilots and chatbots with Dynamics 365 customer service, integrated into Teams and customer apps to handle balance checks, transaction disputes, and onboarding instantly, 24/7.

The Estimated Impact

✅ 30% reduction in call volumes

✅ 40% faster issue resolution

✅ Improved CSAT scores and customer loyalty

2. Real-Time AI Fraud Detection and Prevention

Why This Matters

Fraud costs the banking industry over $42 billion globally each year, while traditional systems miss evolving threats.

What You Can Deploy

AI models that analyze transactions in real-time, detecting suspicious activities with higher accuracy while reducing false positives.

The Estimated Impact

✅ 60% improvement in fraud detection accuracy

✅ Faster intervention to prevent losses

✅ Reduced customer friction

3. Intelligent Document Processing for Loans and KYC

Why This Matters

Banks spend thousands of staff hours annually on manual document checks, slowing loan approvals and compliance processes.

What You Can Deploy

AI-driven document extraction and analysis to process loan forms, ID documents, and compliance paperwork automatically.

The Estimated Impact

✅ 70% faster loan processing (from days to hours)

✅ Up to 40% reduction in processing costs

✅ Increased onboarding speed and customer satisfaction

4. Predictive Analytics for Hyper-Personalized Banking

Why This Matters

Only 20% of banking customers feel their bank understands them, leading to lost cross-sell and upsell opportunities.

What You Can Deploy

AI models that analyze behavior and transactions to predict needs and deliver personalized product offers and insights.

The Estimated Impact

✅ 25–35% increase in cross-sell conversion rates

✅ Stronger customer loyalty and lifetime value

✅ Increased marketing ROI with precision targeting

5. Compliance Monitoring and Risk Management

Why This Matters

Global banks spend over $270 billion annually on compliance operations, often with manual, error-prone processes.

What You Can Deploy

AI-powered compliance monitoring to scan transactions and communications, flagging suspicious activity while automating regulatory reporting.

The Estimated Impact

✅ 50% reduction in manual compliance workload

✅ Improved regulatory adherence and audit readiness

✅ Reduced operational risk

Why Start Now?

IBM, McKinsey, Microsoft, and Netwoven agree: Banks that deploy AI now see immediate, measurable operational improvements while building readiness for future AI transformation.

Using Microsoft’s secure, compliant AI ecosystem, you can

✅ Slash operational costs

✅ Improve customer loyalty

✅ Reduce fraud and compliance risks

✅ Free your teams from manual processes

All while building your bank’s future-ready AI capabilities.

Research Brief: AI Banking

Discover the top 5 churn triggers in community banking-and how to counter them with AI, data, and Microsoft Cloud tools.

Download the research brief to explore proven strategies that turn everyday transactions into lasting customer loyalty.

Ready to Begin Your Journey of Artificial intelligence in Banking?

At Netwoven, we help banks

✅ Identify the highest ROI AI use cases

✅ Start small to immediately realize ROI

✅ Rapidly deploy secure Microsoft-powered AI solutions

✅ Train teams for adoption and governance

✅ Build scalable AI foundations aligned with your business goals

🚀 Book Your Free AI in Banking Readiness Assessment

It’s important to know you can start small. However, not starting at all can have lasting impacts.